PDF/A-3: The Electronic Invoice

PDF/A-3: The Electronic Invoice

PDF/A

PDF/A-3: The Electronic Invoice

Summary:

This article gives an overview of the PDF/A-3 format and the applications based on it's container format to store additional information as attachments.

ISO Standard PDF/A

The ISO standard format PDF/A prevailed since the introduction back in 2005. The idea is to provide a standard PDF profile that contains a number of rules and constraints to ensure that the document is 100% self-contained and can be uniquely reproduced.

Adding Attachments to PDF/A Documents

PDF/A-3 allows attachments in any format to be added to PDF documents.

The option to embed additional documents into standardized PDF documents was a highly requested feature from various industries including healthcare and government in order to attach additional, structured data to documents.

Electronic Invoices

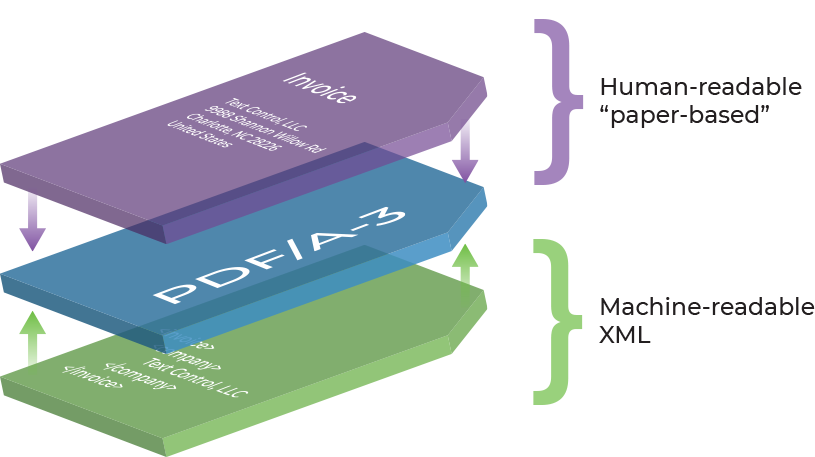

In case of the electronic invoice, a machine-readable XML part can be embedded. The processing application is not specialized in reading PDF documents, but is able to extract the structured attachment which is then processed by the commercial software that is able to read this attachment.

In many countries including Germany, there are regulations and new laws regarding electronic invoices. The tax simplification law (Steuervereinfachungsgesetz 2011) is equating the electronic invoice with the traditional, printed invoice.

Based on the directive, an electronic invoice must consist of the following required components:

- The receiver must consent to receive electronic invoices (or not opt-out).

- The invoice must be created, send, received and processed in an electronic format.

- The invoice must be readable by humans.

- The origin and authenticity needs to be provable.

- The invoice integrity must be guaranteed.

- Typical mandatory invoice details must exist (tax identification number, ...).

The ZUGFeRD Invoice

ZUGFeRD (Zentraler User Guide des Forums elektronische Rechnung Deutschland) is a specification for a format that describes electronic invoices.

The advantage of such a document is that the embedded file can be easily processed by machines and the document itself can be visualized by any standard PDF reader and is therefore robustly archivable backed by the original PDF/A idea.

Conclusion

This powerful combination of paper-based PDF documents and machine-readable attachments enables data exchange and automated processing by the recipient without knowing anything about the visual representation of the document. At the same time, the visual layout and pixel-perfect representation is still required by law and important for the acceptance of electronic invoices. Even if electronically processed, invoices need to be controlled and checked by humans in case of mistakes and inconsistencies.